October 4, 2019

Many Minnesota employers are grappling with correctly understanding and implementing the new Wage Theft law, effective July 1st of this year.

Most employers accurately pay their employees for work performed. However, when this doesn’t happen and when an employer fails to correctly pay all wages earned by employees, it is now considered wage theft in Minnesota.

What is the Wage Theft Law?

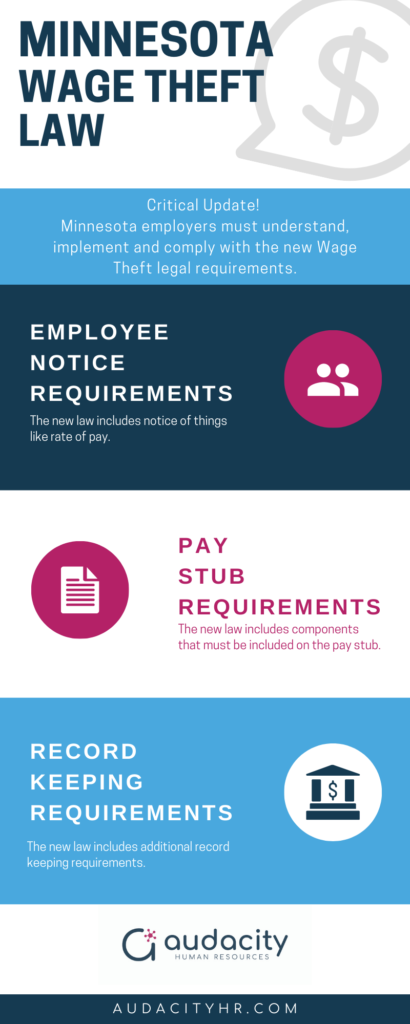

The new law involves sweeping changes. Among other things, Minnesota employers must provide notice and keep a signed “wage statement” on file for each employee.

In addition, the new law includes recordkeeping requirements as well as additional authority for the Minnesota Department of Labor and Industry (DLI) to monitor compliance.

DLI estimates more than 39,000 workers suffer from wage theft statewide each year. This results in $11.9 million of wages owed, but not paid to Minnesota workers.

One purpose of the law is to eliminate instances of wage theft, as described above. Another goal is to provide greater transparency and clarity for workers, especially regarding things like overtime and deductions from pay. It also provides non-retaliation provisions and punishes employers that retaliate against employees who assert their rights under the new law.

Wage Theft Law: The Employee Notice

The new law requires employers to provide employees with a written notice at the start of their employment. That means, employers are required to provide this information to employees hired, or employees whose wage arrangements change, on or after July 1st. The notice must include information such as:

- The employee’s rate (or rates) of pay and the basis for payment, such as whether the employee is paid by the hour, shift, day, salary, commission or other method.

- Allowances that may be claimed for meals and lodging (if applicable).

- Access to paid time off (vacation, sick time or other paid time-off), how it will accrue and terms of use.

- The employee’s employment status and whether the employee is exempt from things like minimum wage and overtime.

- A list of deductions that may be made from the employee’s pay (for example, health insurance deductions).

- The number of days in the pay period, the regularly scheduled payday and the payday on which the employee will receive the first payment of wages earned.

- The legal name of the employer and the operating name, if different.

- The employer’s telephone number and physical address (and mailing address, if different).

The notice should be signed by the employee and retained by the employer (for example, in the personnel file). A sample notice is provided on the DLI website.

Are Management Employees Exempt from the Notice Requirement?

A common question is whether management level employees paid on a salary basis must also be provided with the written notice. The short answer is yes. According to DLI, the new law does not exclude any employees from the written notice requirement.

Additional Records

Another new aspect of the law requires employers to track and retain a list of the personnel policies provided to each employee. The law also requires a brief description of the policy, and the date it was given to each employee.

The Timing of Wage Payments

Employers must pay all wages at least every 31 (thirty-one) days and all earned commissions at least every three months on a regular pay day.

Wage Theft Protections

The new law makes it a crime to commit “wage theft.” Examples of wage theft include (if done with the “intent to defraud”):

- Failing to pay an employee all wages, salary, gratuities, earnings, or commissions as required by federal, state, or local law;

- Directly or indirectly causing any employee to give a receipt for wages for a greater amount than that actually paid to the employee for services rendered;

- Directly or indirectly demanding or receiving from any employee any rebate or refund from the wages owed the employee; or

- Making it appear in any manner that the wages paid to any employee were greater than the amount actually paid to the employee.

The wage theft protections were effective August 1st. If employers are not yet paying attention, it’s time to start! Failure to comply with these provisions could result in felony level charges.

Wage Theft Law: What’s Next?

Covered employers should take immediate steps, including:

- Creating and utilizing the required employee notice,

- Creating or revising a policy acknowledgement form, and

- Making sure pay stubs (earnings statements) comply with the new law.

In conclusion, this post is a mere summary of a complex new law. It is important for employers to review the requirements in full and seek out help as needed to ensure compliance.

About the Author

HR thought leader, Stacy Johnston, provides innovative HR solutions with a mission to support organizations in understanding and engaging their biggest competitive advantage… their employees. Johnston writes and speaks about contemporary HR topics. She is a licensed attorney and holds the SHRM-CP and PHR credentials.

Interested in wage theft compliance assistance or more HR tips? Check out our online resources or reach out to us for a free and confidential consultation.

Originally published in Business North magazine.

Photo Credit: pepi-stojanovski on unsplash

Looking for HR Solutions?

We break down complex HR concepts into language that is easy to

understand, delivering real-world ideas and bold, innovative solutions.

Stay on track and organized, with relevant and valuable information

from Audacity HR!

You’re busy. We get it! Our solutions save you TIME and MONEY.